Blog

Gryphon Compliance Pays Marketing Dividends for Leading Financial Institution

February 28, 2025Case Studies

Company Spotlight

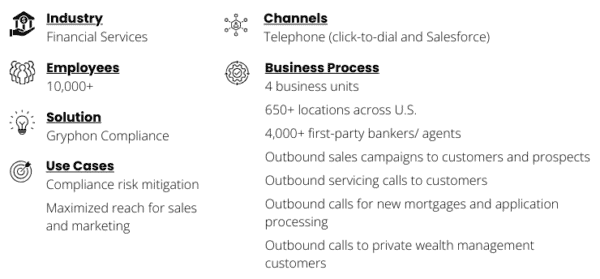

Background

- A leading U.S. financial institution catering to millions of customers nationwide underwent organizational restructuring across multiple business units

- Resources and teams were merged to support future initiatives

- Previously independent business units now require a more integrated approach for outreach and compliance processes

Challenge

- Ensuring legal and corporate compliance for capturing and documenting consent

- Synchronizing consent capture across interaction points and business units

- Managing fragmented internal Do Not Contact (iDNC) lists across business units

- Increasing marketable leads and revenue potential

Solution

- Continuous database monitoring to reclaim locked records

- Identifying new customer consents for legal marketing outreach

- Expiring opt-out records per federal and state rules

- Data hygiene to update Do Not Call records with changed ownership

- Automated reporting and audit trails

Results

- Recovered 51 million records, enhancing outreach potential

- Increased marketable universe by 50%

- Unlocked sales opportunities worth hundreds of millions of dollars

Why Gryphon?

- Market leader for contact compliance solutions, protecting the bank from fines and litigation

- Consultative partner providing ongoing support and recommendations, aiding the bank in navigating changes and managing reach

- Enterprise solution, empowering increased revenue potential while ensuring regulatory compliance

Want to read the full case study for more insights? Get your copy here.

Related Posts

Background Prominent payment solutions provider faced challenges managing regulatory compliance amid significant growth and expansion Considered solutions like Gryphon ONE for Compliance too costly and restrictive to outreach Developed an…

Company Spotlight Background Fortune 100 Property & Casualty insurance carrier struggled with manual lead processing Faced issues with contact compliance and operational efficiency Needed a centralized, automated solution for lead…

Company Spotlight Background A leading U.S. financial institution catering to millions of customers nationwide underwent organizational restructuring across multiple business units Resources and teams were merged to support future initiatives …