Gryphon ONE for Collections

Debt collection teams operate in a challenging landscape where maximizing outreach is key to driving revenue recovery. A strong collections platform expands database reach, improves contact rates, and supports compliant, efficient debtor communications.

Benefits

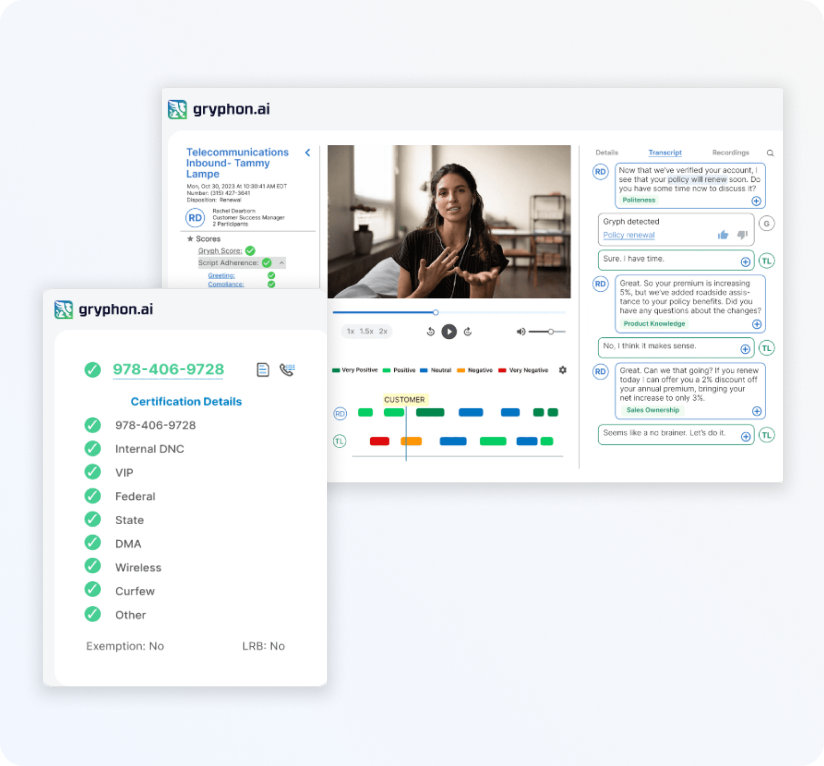

Leverage regulatory adherence, real-time monitoring, and automated auditing to optimize recovery efforts while mitigating risk with debt collection compliance software.

Collections Use Cases

Expand Reach While Ensuring Compliance

Adapt to evolving regulations while optimizing collection efforts with intelligent compliance solutions.

- Regulatory Intelligence: Stay ahead of legal changes to avoid penalties and maintain compliant strategies.

- Real-Time Compliance Validation: Monitor all communications to align with TCPA, FDCPA, and CFPB compliance standards, protecting against financial and legal risks.

- Data-Driven Campaign Design: Attribute data with intelligence to design compliant campaigns that maximize recovery rates.

Balance Debt Recovery with Consumer Protection

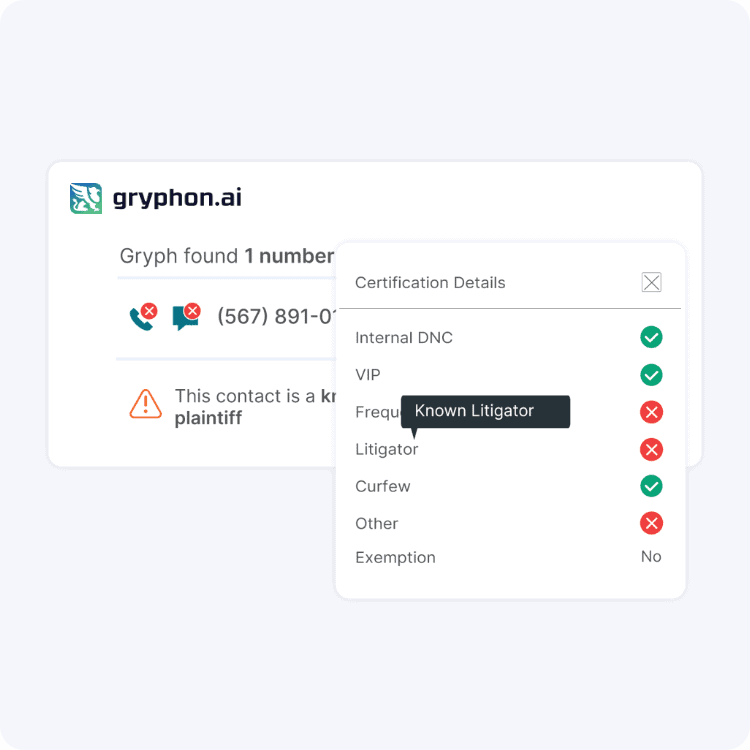

Implement a compliance-first approach to ensure fair and effective outreach.

- Channel-Appropriate Communication: Use the right channels while adhering to legal restrictions on call frequency and timing.

- Harassment Prevention: Automate safeguards to block calls that could be flagged as harassment and avoid known litigators or plaintiffs.

- Flexible Outreach: Adjust messaging and frequency to align with debtor preferences and regulatory requirements within CFPB debt collection guidelines.

Real-Time Compliance for Every Consumer Interaction

Proactively monitor and enforce compliance in real-time to avoid violations.

- Dynamic Blocking: Prevent non-compliant calls using intelligent parameters such as area code versus ZIP code mismatch, call frequency, and curfew restrictions.

- Continuous Updates: Automatically adapt to new regulations and legal precedents to maintain uninterrupted compliance.

- Regulatory Alignment: Ensure every interaction follows TCPA, FDCPA, and CFPB guidelines without disrupting collection efforts.