The future of enterprise financial services

In today’s landscape, expectations from tech-savvy customers and competition from digital-first and fintech disruptors have intensified the need for firms to leverage technology to gain a competitive advantage.

Coupled with strict compliance and regulatory standards, enterprises must balance stringent regulations while simultaneously focusing on exceptional customer experience.

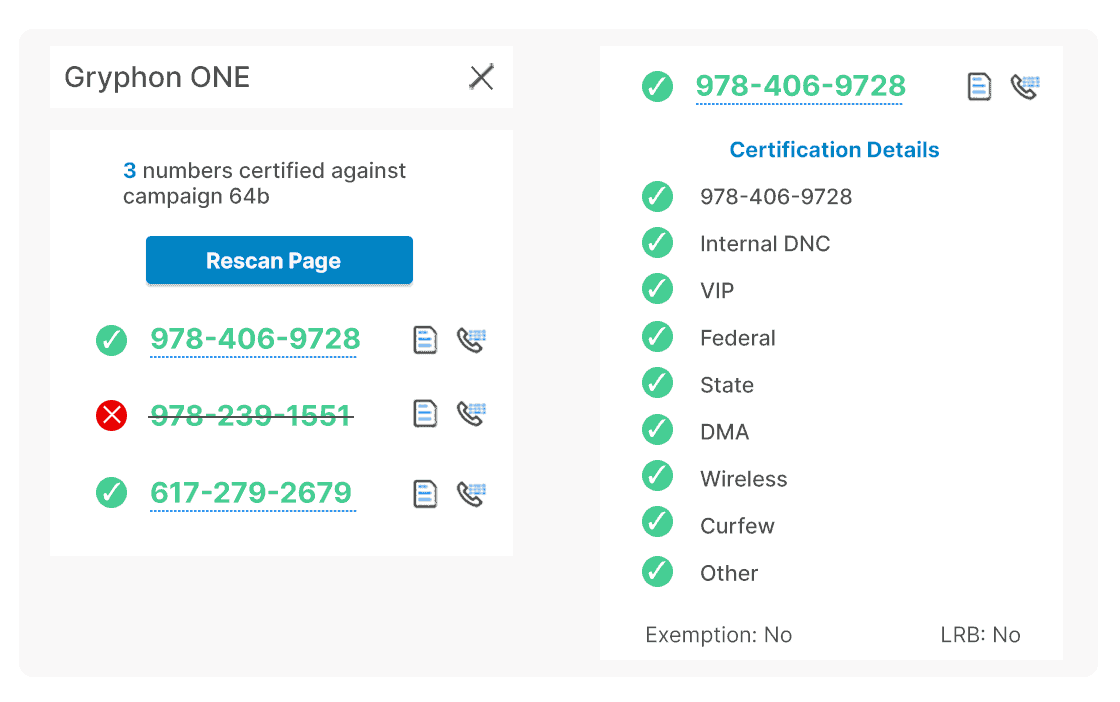

Eliminate TCPA and DNC threats across the organization

Gryph for Compliance enables outbound teams to pursue leads ethically and foster quality sales conversations in a highly regulated industry.

With complex and continuously changing TCPA and DNC regulations, Gryph for Compliance evaluates every outbound call against TCPA, state, federal, and other Do Not Call lists in real-time and automatically blocks calls that put your organization at risk.

Our platform includes comprehensive reporting to ensure protection from compliance audits.

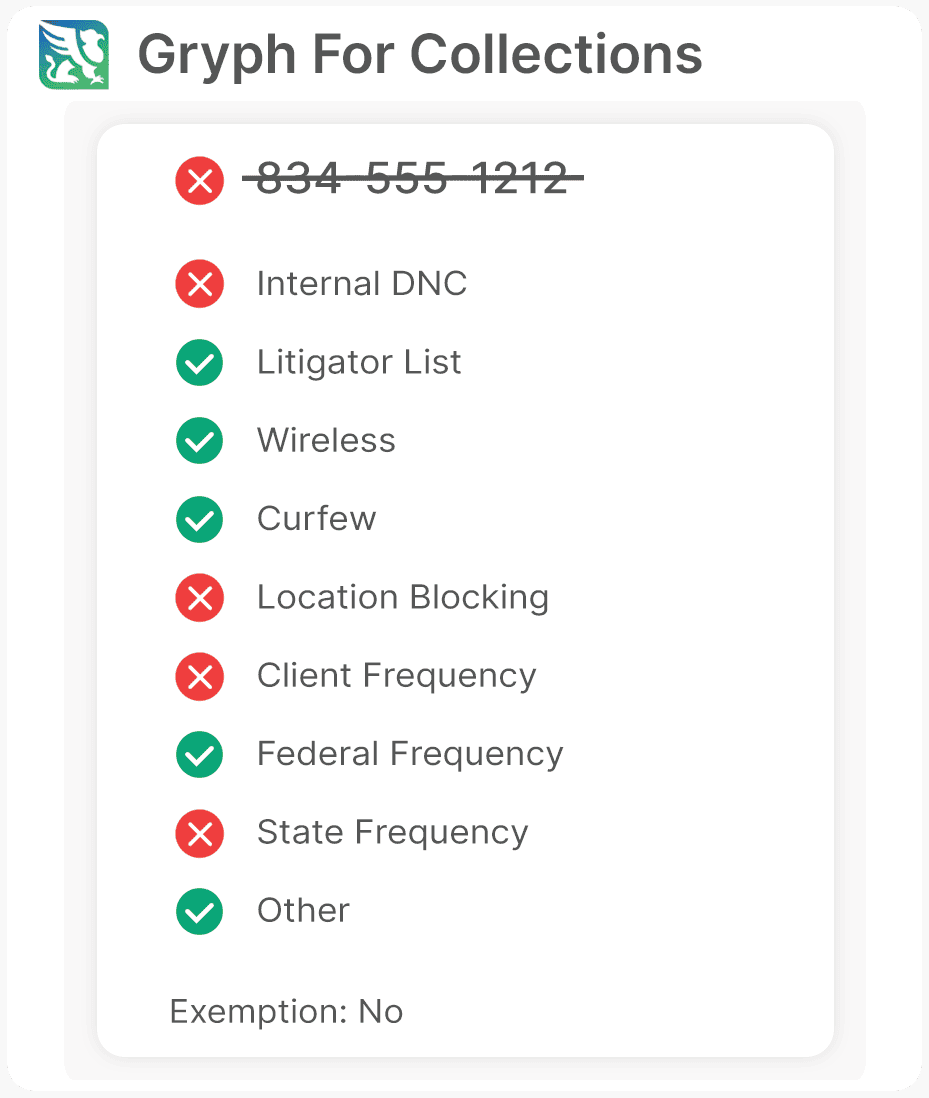

Automate your collections compliance process

First- and third-party debt collection organizations face increasing regulations at the federal, state, and local levels.

Gryph for Collections provides a comprehensive real-time screening and blocking solution that gives first- and third-party consumer collections organizations the power to comply with the vast, ever-changing regulatory landscape.

It creates a fully auditable trail to demonstrate compliance while mitigating risk.

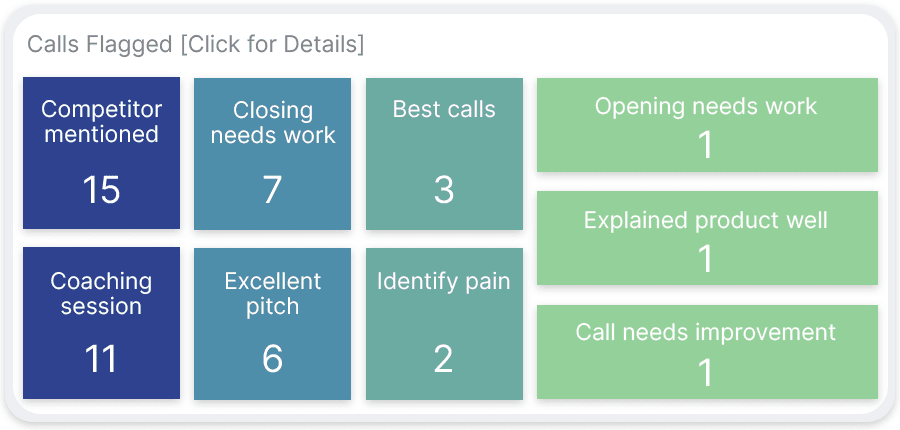

Leverage conversation insights across the entire enterprise

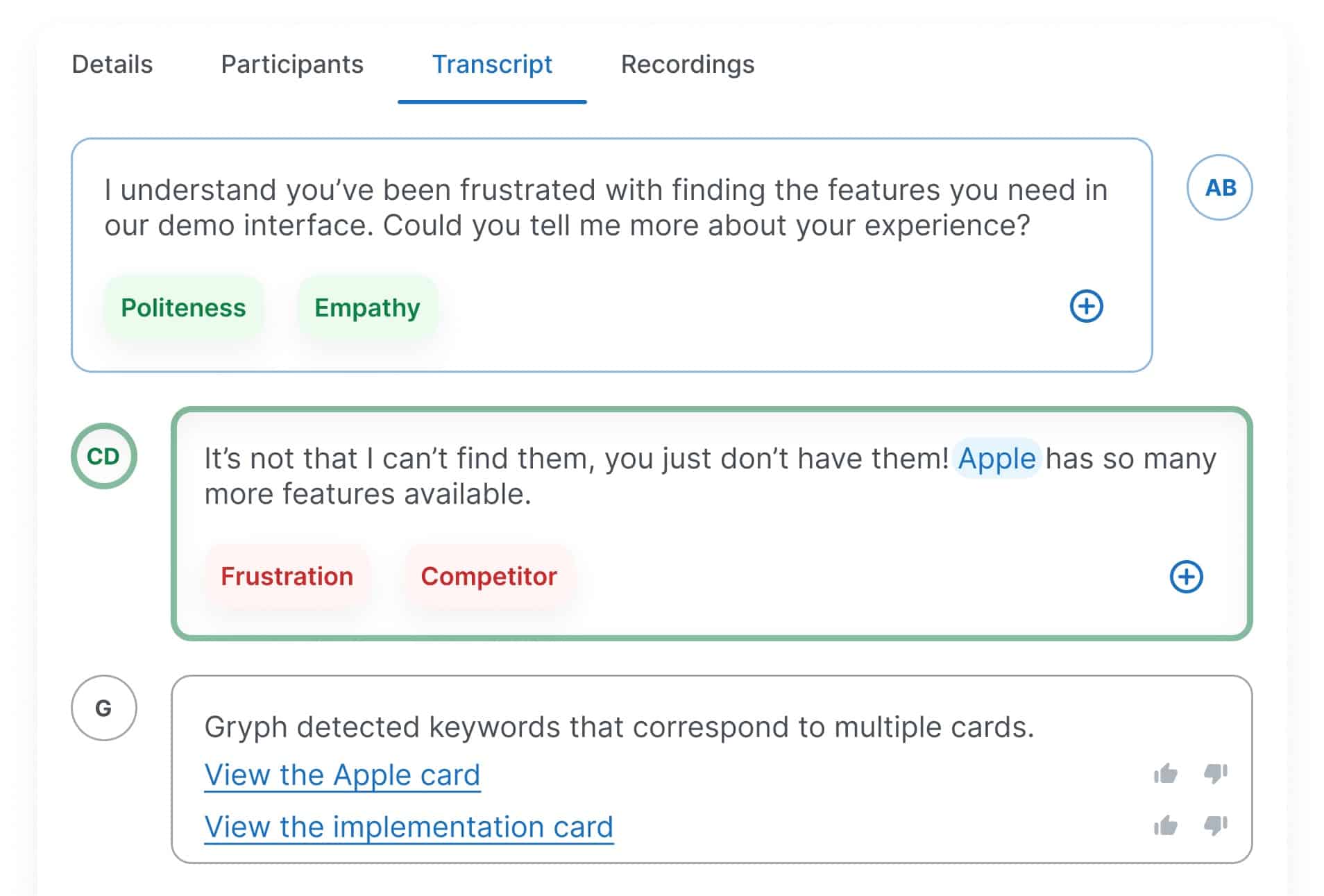

Gryph for Conversation Intelligence provides critical insights into each customer interaction and identifies areas of customer experience improvement.

Enterprises can define target KPIs for sales and service interactions and track call quality with comprehensive call analytics.

Teams can close the loop to improve CX initiatives by identifying calls to action in real-time.

Conversation Intelligence also assists QA teams with GLBA compliance monitoring while concurrently empowering marketing teams to identify customers’ needs and interests to develop targeted outreach campaigns.

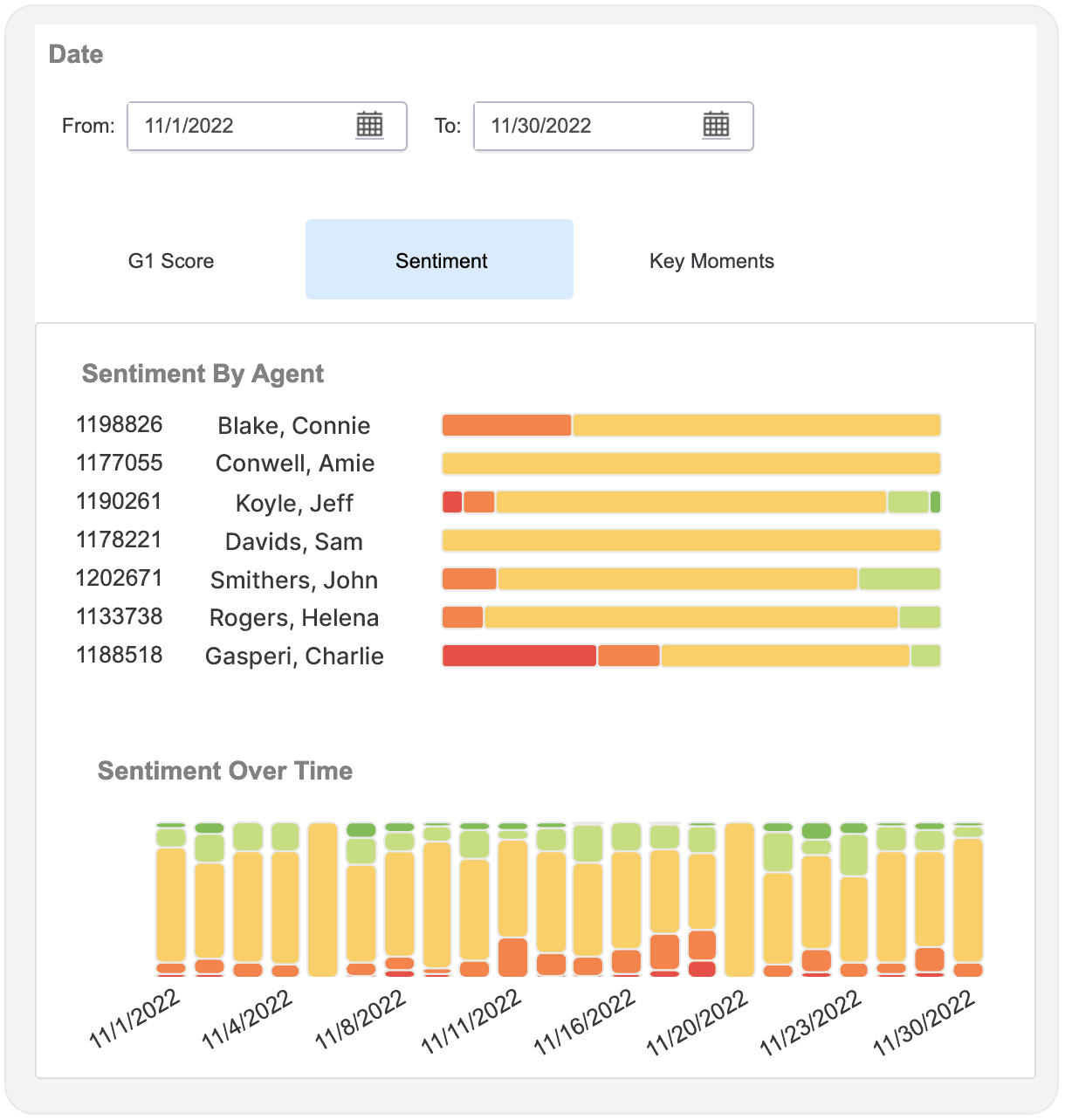

Analyze the sentiment of your customers and prospects

Understanding the sentiment of each customer interaction drives continuous improvements in customer experience initiatives.

Target the sentiment that causes customers to buy more and stay longer with the only real-time Sentiment Analysis solution.

From a comprehensive view of your customer base to detail on each conversation, gain a full understanding of the sentiment toward your organization.

Gryphon’s Sentiment Analysis solution empowers your organization to provide proactive solutions for agent training and create processes that improve customer satisfaction and retention rates.

Empower representatives with real-time coaching

AI-powered mentoring gives financial service reps, bankers, and wealth managers contextual talking points, FAQs, and knowledge base materials to answer questions and resolve customer issues in-the-moment.

Improve onboarding while replicating the behaviors of your most successful reps.

Real-time guidance helps enterprises reduce customer wait times, decrease abandonment rates, improve first call resolution rates, increase the number of calls handled, and maximize customer satisfaction scores (CSAT).