Below is a recap of the essential regulatory updates for contact compliance professionals for August.

This is a marketing blog and is not intended, nor should it be interpreted, as legal advice. Please seek legal counsel for full interpretations of all rules and laws outlined in this blog.

Keep Call Centers in America Act: What Businesses Need to Know About Offshore Call Centers and Compliance

In 2025, the U.S. Senate introduced the bipartisan Keep Call Centers in America Act, a significant legislative effort aimed at bringing transparency, accountability, and job security back to the call center industry. Call center jobs employ about 3 million people nationwide, but have seen sharp declines as companies increasingly implement offshore operations or replace agents with AI-driven systems.

Key Provisions and Disclosure Requirements

The Act requires businesses with call centers employing 50 or more people (full-time equivalents) to notify the Department of Labor at least 120 days in advance if they plan to move call center operations overseas or outsource 30% or more of the work to foreign providers. This advance notice enables the government to inform the public and maintain a public registry of companies offshoring call center jobs.

One of the unique provisions mandates clear disclosure to customers about their call center agent’s physical location at the start of every interaction. If the agent is overseas, callers must be told they have the right to request a transfer to a U.S.-based agent. Similarly, if AI is used for customer service, its use must be disclosed at the conversation’s outset.

Consequences for Relocating Overseas

Companies that fail to comply face serious consequences. Their names remain on the public offshore call center list for up to five years, potentially damaging brand reputation.

More significantly, they become ineligible for new federal grants, guaranteed loans, and may lose or face penalties on existing federal contracts during that period. These financial impacts underscore the law’s clear goal: to incentivize domestic job retention.

Business Impact and Compliance Considerations

For businesses, particularly financial institutions and large service providers, the Act means reevaluating offshore call center strategies and ensures compliance with notification and disclosure requirements. Non-compliance risks not only include federal funding loss but also growing consumer distrust amid rising demand for transparency and quality service.

With AI transforming customer interactions, the Act also compels companies to integrate technology ethically by informing consumers and offering real human assistance domestically.

In short, the Keep Call Centers in America Act is a decisive step towards protecting American call center jobs while enhancing customer service transparency. Businesses must prepare now by reviewing outsourcing plans, upgrading customer communication scripts, and tightening compliance protocols to avoid penalties and maintain customer trust.

The Growing Wave of TCPA Litigation & Settlements: Year-to-Date Insights

(source: Webrecon June 2025, Webrecon July 2025)

June 2025

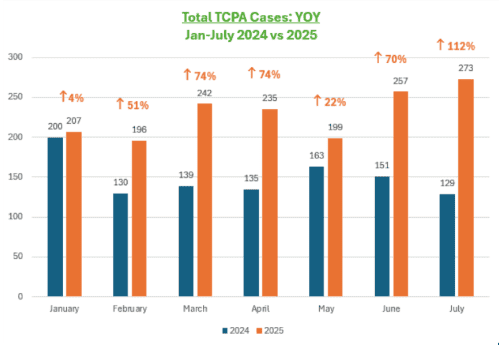

June yielded a significant surge in TCPA litigation, with 257 new cases filed, a jump of 29.1% from May and a 45% increase year-to-date compared to the same period last year.

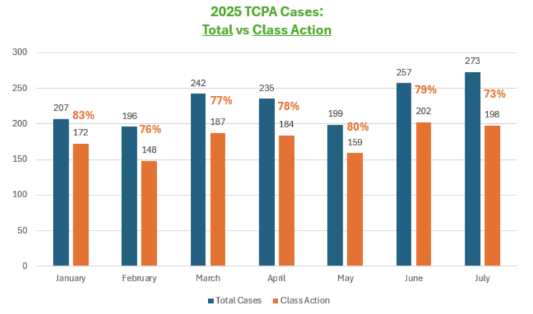

Class actions dominated the landscape, comprising 78.6% of TCPA filings, increasing legal and financial risk for outbound callers.

About 43% of plaintiffs had filed previous lawsuits, highlighting repeat litigant activity.

July 2025

The upward trend continued in July, with TCPA cases rising yet again (6% increase over June) after a slight lull in May.

The prevalence of class actions remained extraordinarily high, historically speaking, maintaining pressure on telemarketing operations to ensure strict compliance.

Year-to-Date

The year 2025 continues to see a remarkable surge in Telephone Consumer Protection Act (TCPA) litigation, with case filings consistently outpacing 2024 levels. Across the first seven months of the year:

- A total of 1,609 TCPA cases have been filed between January and July 2025, marking an impressive 110% increase compared to the 767 cases reported during the same period in 2024

- Class actions remain a dominant feature, accounting for nearly 79% of TCPA cases filed monthly, amplifying potential liabilities for businesses

- Roughly 40-43% of plaintiffs are repeat litigants, underscoring a significant proportion of repeat lawsuits contributing to case volume

- TCPA lawsuits are spread across over 150 U.S. District Courts, with hotspots including Georgia (Atlanta), California (Los Angeles, Santa Ana), Illinois (Chicago), and Florida (Tampa, Miami)

- The number of unique plaintiffs has grown steadily, surpassing 5,500 for the year, collectively filing over 4,000 lawsuits since 2001

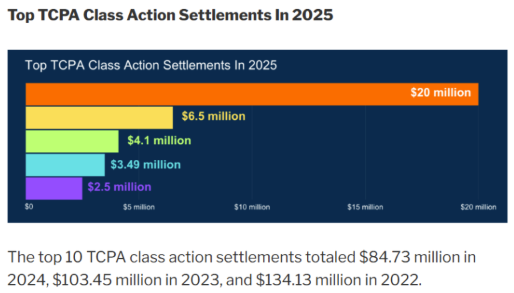

2025 YTD TCPA Class Action Settlements

Per the Duane Morris 2025 Mid Year Class Action Settlement Report & Analysis (January through June 2025), settlement amounts have been very lucrative for the plaintiff’s class action bar across all categories; TCPA settlements reached $34.77 million.

- $20 million – Bumpus, et al. v. Realogy Holdings Corp., Case No. 19-CV-3309 (N.D. Cal. Mar. 10, 2025) (preliminary settlement approval granted in a class action to resolve claims alleging that the company made harassing phone calls from real estate agents in violation of federal telemarketing restrictions).

- $6.5 million – Williams, et al. v. PillPack LLC, Case No. 19-CV-5282 (W.D. Wash. Apr. 18, 2025) (final settlement approval granted in a class action to resolve claims alleging Amazon.com affiliate PillPack LLC was responsible for unsolicited telemarketing calls that violated a federal consumer law restricting robocalls and texts).

- $4.1 million – Truong, et al. v. Truist Bank, Case No. 23-CV-79 (W.D.N.C. Apr. 30, 2025) (preliminary settlement approval granted in a class action to resolve claims alleging that the defendant placed robocalls to cellphone numbers regarding unrelated accounts in violation of the TCPA).

- $3.49 million – Johnson, et al. v. United HealthCare Services Inc., Case No. 23-CV-522 (M.D. Fla. July 10, 2025) (final settlement approval granted in a class action to resolve claims alleging the company violated the TCPA by placing calls to consumers about its Optum HouseCalls program).

- $2.5 million – Samson, et al. v. United HealthCare Services, Inc., Case No. 19-CV-175 (W.D. Wash. June 20, 2025) (final settlement approval granted in a class action to resolve claims alleging that the company made telemarketing calls to non-members in violation of the TCPA).

This persistent rise in TCPA litigation highlights an increasingly aggressive legal environment for telemarketers and businesses relying on automated calls or texts. Strict TCPA compliance – encompassing prior express written consent, meticulous do-not-call list management, and clear disclosures (among others) – is more critical than ever to mitigate litigation risk and financial exposure.

September 2025 Holiday Telephone Solicitation Bans

Please be aware of the following U.S. holiday telephone solicitation bans for the month of September 2025:

- On September 1, 2025, Alabama, Louisiana, Nebraska*, Pennsylvania, Rhode Island, and Utah prohibit unsolicited sales and marketing calls to residents in observance of Labor Day.

Other holidays may be proclaimed by the Governor in each state throughout the year.

*Nebraska does not prohibit calls on Sundays or legal holidays; however, it does restrict the use of prerecorded messages to 1 pm to 9 pm on these days (subject to certain exceptions).

Please be aware of the following Canadian holiday telephone solicitation bans for the month of September 2025:

- On September 1, 2025, unsolicited sales and marketing calls to residents of all provinces and territories are prohibited in observance of Labour Day.

- On September 30, 2025, unsolicited sales and marketing calls to residents of the following provinces and territories are prohibited in observance of the National Day of Truth and Reconciliation: British Columbia, Manitoba, Northwest Territories, Nunavut, Prince Edward Island, and Yukon.

Gryphon has updated its existing service parameters to reflect these solicitation bans.

NY State of Emergency Issued through September 25, 2025

Consistent with prior communications, Executive Orders declaring disaster emergencies in the State of New York trigger telemarketing restrictions under the Nuisance Call Act.

The Nuisance Call Act makes it unlawful for any telemarketer to make unsolicited telemarketing sales calls to areas of the state under an emergency declaration.

Executive Order 47.9 declaring a State Disaster Emergency in the State of New York arising from an illegal and unlawful strike by correction officers, was extended through September 25, 2025.

Also, Executive Order 50 was issued due to weather related concerns and is effective through August 30, 2025.

Gryphon has extended State of Emergency blocks for New York to September 25, 2025, to ensure compliance with the above Executive Orders.

U.S. QUIET Act (H.R. 1027) Gains One in August

The Quashing Unwanted and Interruptive Electronic Telecommunications Act (QUIET ACT), which proposes the disclosure of Artificial Intelligence (AI) use at the beginning of a telemarketing call, along with increased penalties for violations involving AI voice or text messages, now has 20 total co-sponsors including original co-sponsor Sorensen (IL) and with Representative Josh Gottheimer (D-NJ) joining in August.

Ecommerce Innovation Alliance (EIA) is Determined to Stay Visible with FCC on Quiet Hours Exception

(See Gryphon AI’s May 2025 Regulatory Report, under “NCLC Offers Strong Opinions on TCPA Challenges: EIA and EEI Petitions to the FCC”)

EIA is showing up at the Federal Communications Commission (FCC) like a friendly but determined neighbor, always around with a helpful nudge to keep the conversation going and top of mind…

EIA urges the FCC to clarify TCPA “quiet hours” for telemarketing calls and texts. EIA proposes a non-rebuttable presumption that a mobile number’s area code determines the recipient’s time zone, protecting businesses if recipients have moved. The petition also asks the FCC to confirm that individuals who provide prior express written consent for marketing texts cannot sue businesses for messages sent outside quiet hours (8 am to 9 pm), aiming to protect legitimate communications and reduce abusive TCPA litigation targeting compliant businesses.

On July 8, 2025, EIA met with the FCC to ensure its views remain part of the regulatory conversation as the FCC reviews these critical issues. The goal is to strike a balance between consumer protections and practical compliance for businesses. The FCC has not yet finalized its response or issued a formal ruling on EIA’s petition.

For the ExParte, click here.

Match Group’s $14M Fine Signals New Era for Canceling Subscriptions

Lawmakers and regulators are stepping up on subscription cancellations, and the action is heating up on both Capitol Hill and in the marketplace. After the Eighth Circuit hit pause on the FTC’s “click to cancel” rule for online subscriptions citing procedural missteps, House Democrats responded with the Click to Cancel Act, aiming to enshrine easy cancellations into law. Their goal? Make ending a subscription as straightforward as signing up, shielding consumers from confusing opt-outs and surprise charges.

Businesses aren’t immune to this shift. Match Group just settled with the FTC, agreeing to pay $14 million and overhaul its cancellation process after accusations that its “six-month guarantee” on dating sites came with hidden hoops and account suspensions tied to billing disputes. The deal also bans Match from punishing users who challenge charges, nudging major companies toward transparency.

While Democrats champion clear rules to protect consumers, businesses are adapting. By streamlining cancellations and clarifying terms, companies can avoid regulatory headaches and build trust. Ultimately, the message is clear: consumers deserve honest, hassle-free options, and the days of subscription “tricks and traps” may be numbered.

(Sources Law360 – 1, Law360-2)

New York’s RING Act: A Powerful Step to Combat Robocalls and Call Spoofing

New York State has taken a strong position against the growing menace of robocalls with the introduction of SB470, the Robocall Identification and Notification for Guarding Consumers Act ( RING Act). This legislation aims to bolster consumer protection by cracking down on illegal robocalls and caller ID spoofing, practices that continue to frustrate millions.

Robocalls – specifically: automated, prerecorded calls – are a frequent source of scams and unwanted interruptions, and spoofing allows callers to fake caller ID information to hide their identity or impersonate trusted numbers. The RING Act addresses both issues by authorizing stronger enforcement tools and penalties against offenders.

Under the RING Act, telemarketers and voice service providers must ensure the accuracy of caller ID information transmitted with each call and must not knowingly transmit or facilitate illegal robocalls. The bill also empowers the New York Attorney General to investigate and bring actions against companies violating these provisions, with fines and injunctions available to stop illicit operations.

For businesses, this law reinforces the importance of compliance with caller ID authentication standards such as STIR/SHAKEN and adherence to federal and state telemarketing rules. Failure to comply will mean potential significant fines and restrictions, along with reputational damage.

Consumers in New York can expect better protection and fewer intrusive robocalls as the RING Act supports federal efforts, such as those by the FCC, to restore trust in telecommunications. This measure is a win-win, protecting consumers while encouraging legitimate businesses to play fair.

In short, New York’s RING Act is a critical step in the ongoing fight against robocall abuse and call spoofing, signaling tougher oversight and stronger consequences for violators.

FCC and State Attorneys General Crack Down on 185 Robocall Voice Providers, then targets ~1200 more: What Businesses Must Know

In a sweeping enforcement initiative, the Federal Communications Commission (FCC) issued an Order on August 6 removing 185 Voice Service Providers (VSPs) from its Robocall Mitigation Database (RMD). But it didn’t stop there: on August 25, the FCC announced additional Enforcement Bureau action removing another ~1200 non-compliant VSPs from the RMD.

This decisive action bars these providers from originating traffic on U.S. phone networks due to non-compliance with anti-robocall rules. The FCC’s crackdown underscores mounting regulatory pressure on telecom companies to stop illegal robocalls – an escalating consumer annoyance and fraud vector.

But the FCC isn’t acting alone. A bipartisan coalition of 51 State Attorneys General, organized as the Anti-Robocall Litigation Task Force, has launched Operation Robocall Roundup to complement federal efforts. Recently, the group issued warning letters to 37 voice providers enabling illegal robocalls, demanding immediate mitigation and compliance. They also alerted nearly 100 downstream providers that receive call traffic from these bad actors, warning them they face consequences for routing unlawful calls. Several providers have faced fines or had their traffic blocked, reinforcing the message that non-compliance won’t be tolerated.

The Task Force cites common violations:

- Failure to file or update robocall mitigation plans in the FCC’s RMD

- Refusal to respond to government traceback requests

- Inadequate enforcement of robocall controls

These oversights allow scammers and fraudsters to flood consumers with thousands of unwanted robocalls daily.

For service providers, the consequences extend beyond fines. Being ousted from the RMD means losing access to major networks, effectively halting operations. This creates steep financial and reputational risks.

To avoid enforcement action, companies must: maintain current and FTC-approved mitigation plans, comply fully with STIR/SHAKEN call authentication standards, monitor and block suspicious traffic, promptly respond to traceback requests, and vet customers carefully to prevent abuse.

This coordinated federal and state crackdown sends a clear message: telecom providers must proactively combat illegal robocalls or face costly penalties and network exclusions. Businesses prioritizing compliance and transparent communication will not only avoid fines but help restore consumer trust in a challenging telecommunications environment.

Oregon Passes New Telemarketing Law Effective January 1, 2026

Oregon’s new telephone solicitation law, HB 3865, introduces major updates that companies need to know about if they engage in telemarketing. Effective January 1, 2026, businesses must comply with the following changes:

- New Time Restrictions: Previously 8 am to 9 pm, calls or texts will now be limited from 8 am to 8 pm

- New Call Frequency Limits: New limits mean only three solicitations per day are allowed, unless your organization has an established business relationship (which means the consumer has interacted with your business within the last 18 months)

- Promotional Texts = Promotional Calls: Texts are now officially counted as solicitations, so companies must carefully review SMS campaigns to avoid compliance issues

- Automated calls: If the call recipient hangs up, new rules require prompt disconnection by the caller and all automated calls must include an opt-out mechanism

- Caller ID: Display must not misrepresent the caller’s identity, and every call or message must clearly identify the company within the first ten seconds.

Debt collection agencies enjoy limited exceptions, but for most businesses, these changes call for a close look at current operations. Now’s the time to update policies, train staff, and review scripts to stay compliant and avoid hefty penalties. In short, Oregon is raising the bar for consumer protection in telemarketing, urging companies to operate with greater transparency and respect for consumer preferences.

Robocalls and TCPA Violations Cost Companies Millions: From $145M Settlements to Legal Battles

Robocall and Telephone Consumer Protection Act (TCPA) violations continue to result in significant multi-million-dollar fines and settlements in 2025, reinforcing the high stakes for companies engaged in deceptive or unauthorized telemarketing practices.

Assurance IQ and MediaAlpha – $145 Million FTC Settlement

In a landmark case, Assurance IQ, a subsidiary of Prudential Financial, and MediaAlpha agreed to pay a combined $145 million to settle Federal Trade Commission (FTC) charges. Assurance IQ misled consumers seeking health insurance by falsely claiming coverage benefits and provider network access, while MediaAlpha generated deceptive leads and flooded consumers with robocalls, including calls to those on Do Not Call lists. The settlement requires these companies to implement rigorous compliance measures and ensure truthful, clear consumer disclosures.

Nomorobo’s Unique Lawsuit Role in the Industry

Nomorobo, a leading robocall-blocking service used by millions, stands out by shifting from pure technology defense to active litigation. Its lawsuit against Synchrony Financial is rare, signaling frustration with ongoing violators. Nomorobo’s sophisticated AI-driven call-blocking tech automatically stops billions of robocalls annually, protecting consumers from spoofed and neighbor-spoofed numbers. By filing suit, Nomorobo emphasizes accountability alongside prevention, underscoring its unique dual role as protector and enforcer in the fight against illegal calls. Full complaint here.

Truist Bank’s $4.1 Million Robocall Settlement

Truist Bank’s $4.1 million settlement announced in May confirms that even well-known financial institutions face consequences for unauthorized automated calls. The case centered on violations of the TCPA through calls made without prior consumer consent, highlighting the importance of respecting telemarketing regulations. Full complaint here.

Together, these cases illustrate a landscape where regulators and industry players aggressively pursue TCPA compliance. Businesses must prioritize clear consent and transparent communication or face steep penalties. Meanwhile, consumers benefit from both technology like Nomorobo and stringent enforcement that aim to put an end to the relentless nuisance and risks of illegal robocalls.

Automated, Transparent, Compliant: Maine’s Chatbot Law Meets Telemarketing

Maine’s new Chatbot Disclosure Law, effective September 23, 2025, requires businesses using artificial intelligence (AI) chatbots or automated voice systems – like those used in telemarketing – to clearly inform consumers when they are interacting with a machine, not a human. This disclosure must be “clear and conspicuous” and presented upfront in any consumer communication. If omitted, companies risk enforcement under Maine’s Unfair Trade Practices Act, with penalties up to $1,000 per violation.

This law specifically covers automated phone systems, prerecorded messages, and AI-driven callbots that simulate human interaction, aiming to protect consumers from deception. It complements existing federal regulations under the Telephone Consumer Protection Act (TCPA), which governs prior consent, do-not-call rules, and requires clear disclosures during telemarketing calls.

Key Risks for Telemarketing Using Automated Calls:

- TCPA violations can lead to hefty fines ($500–$1,500 per call) and lawsuits for calls made without documented prior express written consent

- Ignoring do-not-call lists risks regulatory enforcement and consumer backlash

- Failure to disclose AI interactions as required by Maine and emerging state laws opens the door to costly government crackdowns and can severely tarnish a company’s public image and customer trust

How to Comply and Avoid Risks:

- Obtain explicit, written consent before making prerecorded or automated calls

- Honor do-not-call requests and regularly update internal lists

- Provide clear disclosures during calls that explain the use of prerecorded or automated technology

- Comply with Maine’s chatbot disclosure by informing consumers promptly if they interact with AI, whether in text or over the phone

- Monitor third-party vendors to ensure compliance with these rules

By integrating Maine’s Chatbot Disclosure requirements with TCPA compliance, businesses not only avoid legal risks but also foster transparency and trust with consumers in an increasingly automated telemarketing world.

About Gryphon AI

Staying updated with the latest regulatory changes is crucial for any enterprise aiming to minimize risk and maximize reach. Gryphon AI is the only automatic, real-time, intelligent contact compliance solution on the market that delivers compliant, real-time intelligence into every customer conversation.

With Gryphon AI, enterprises can stay ahead of the regulatory curve and efficiently manage all regulatory changes, ensuring seamless compliance and operational excellence.

To learn more about how Gryphon AI can help you manage these updates, reach out to us today.

Related Posts

Below is a recap of the essential regulatory updates for contact compliance professionals for February. This is a marketing blog and is not intended, nor should it be interpreted,…

Below is a recap of the essential regulatory updates for contact compliance professionals for January. This is a marketing blog and is not intended, nor should it be interpreted,…

Below is a recap of the essential regulatory updates for contact compliance professionals for December. This is a marketing blog and is not intended, nor should it be interpreted, as legal…