Gryphon ONE for Customer Experience

Customer service teams must optimize support while elevating service quality. Empower your agents with process modernization to ensure compliant, high-impact conversations that drive revenue, enhance customer experience, and reduce risk.

Benefits

Customer Service Use Cases

Enhance Efficiency and Customer Experience

Deliver sophisticated, AI-powered, regulatory compliant and conversation intelligence solutions.

- Provide accurate, empathetic, customer-focused servicing.

- Centralize conversation management, automating quality assurance processes.

- Ensure compliance across all customer-agent interactions.

- Contextual, real-time data capture and support during customer conversations.

- Regulatory disclosure assistance, improved data accuracy, and reduced error rates.

- Seamless workflow eliminating manual data entry on multiple screens.

- Flexible, compliant processes adaptable to diverse business requirements and customer needs.

- Configurable transcription options, automated conversation summarization, and actionable analytical insights.

Ensure Trust and Transparency with Call Center Authentication

Reinforce your brand’s credibility by ensuring that customer calls display accurate company details.

- Branded Call Display: Increase answer rates and build trust by displaying your company name and number on recipient devices.

- Anti-Spoofing Protection: Prevent fraud and protect your brand by ensuring only verified calls reach customers.

- Enhanced Customer Trust: Strengthen customer relationships with transparent and recognizable communication.

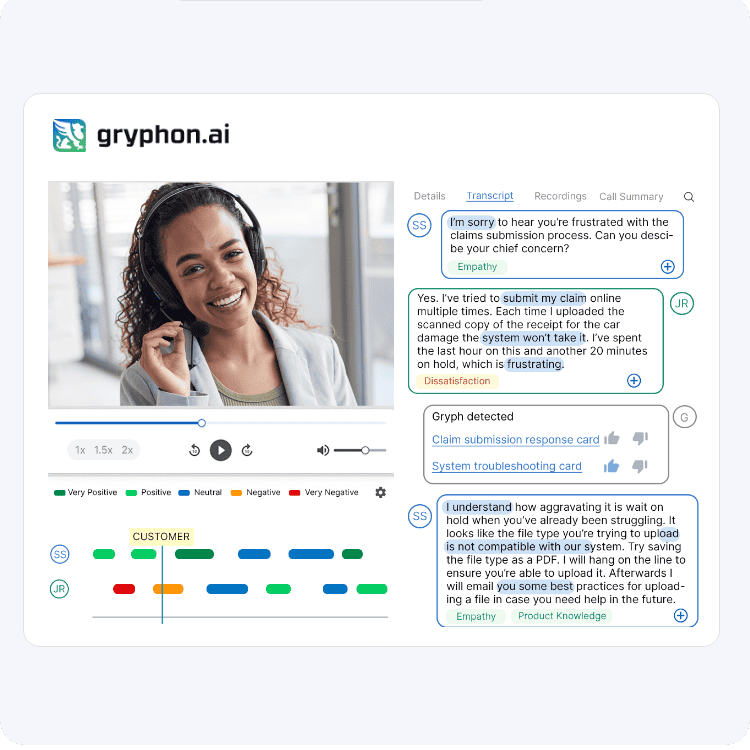

Automate Call Quality Monitoring

Leverage AI-driven insights to optimize customer interactions and agent performance with call center quality monitoring.

- AI-Driven Call Analysis: Automatically analyze conversations for compliance, sentiment, and key insights.

- Data-Driven Coaching: Provide objective performance feedback based on real conversation data.

- Service Quality Optimization: Identify high and low performers to enhance training and improve consistency.

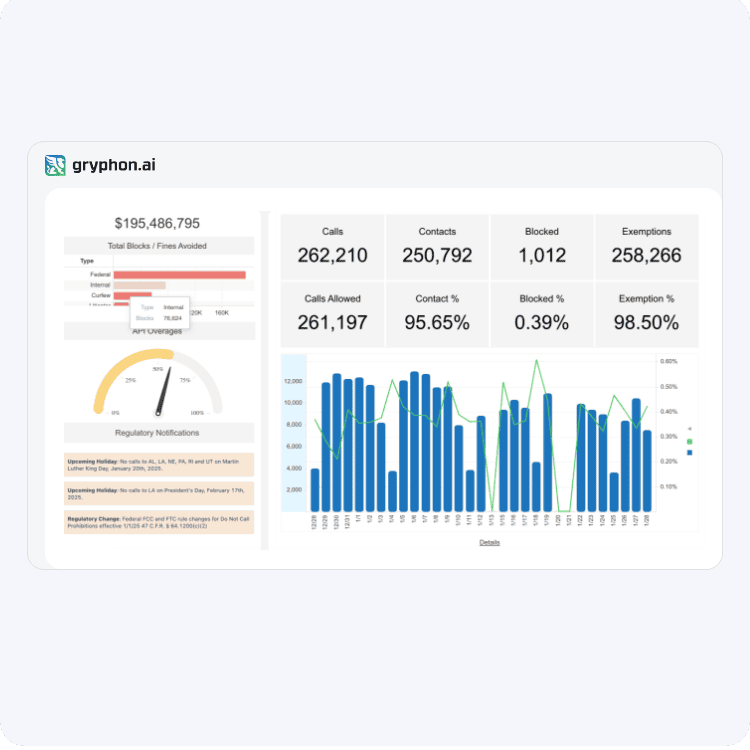

Compliance Reporting for Accountability

Ensure transparency with full audit trails and compliance documentation.

- Detailed Compliance Logs: Access a full history of all customer interactions and compliance verifications.

- Regulatory Readiness: Maintain auditable reports to ensure adherence to evolving compliance requirements.

- Discrepancy Resolution: Quickly identify and address any compliance concerns with documented proof.

Seamless Consent and Preference Management

Enhance customer control while maintaining compliance across all engagement channels with consent and preference management.

- Multi-Channel Preference Support: Allow customers to set communication preferences across phone, email, and digital platforms.

- Branded Customer Experience: Provide a seamless interaction through a user-friendly interface.

- Automated Regulatory Exemptions: Apply relevant exemptions while ensuring compliant and personalized outreach.

Real-Time Compliance for Every Conversation

Ensure servicing teams engage customers confidently without risk.

- Live Compliance Safeguards: Monitor conversations in real-time to prevent non-compliant interactions.

- Legal Adherence: Protect against TCPA, FDCPA, and CFPB violations to maintain a strong brand reputation.

- Operational Efficiency: Remove compliance friction so teams can focus on delivering exceptional service.