Company Spotlight

Background

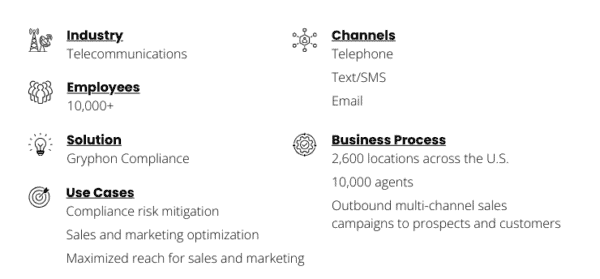

- Telecommunications leader with 2600+ locations across the U.S.

- Operational challenges led them to acquire a prepaid wireless company

- Transitioning to a postpaid model to become a major mobile carrier in the U.S.

Challenge

- Engaging in more intensive subscriber acquisition efforts

- Increasing customer upsell and retention

- Expanding sales efforts beyond their retail stores

- Developing new marketing campaigns tailored to a competitive postpaid market

- Mitigating regulatory risk is crucial since a prior TCPA lawsuit led to a multi-million-dollar payout

Solution

- Real-time contact compliance that blocks illegal communications to prevent regulatory risk

- Centralized compliance enforcement that can support remote personnel and adapt as they scale their outreach efforts

- Custom controls for identifying legal and business-specific exemptions to maximize reach while maintaining regulatory compliance

Results

- 49% increase in contacts from 2023 to 2024

- Expanded multi-channel reach year-over-year with company-specific exemptions:

- Phone: 99% to 100%

- Text: 88% to 94%

- Email: 70% to 89%

- Potential to re-establish marketing outreach to 2.25+ million customers, driving millions in revenue potential

Why Gryphon?

- Trusted partner, providing ongoing strategic support that enables them to focus on their business rather than the regulatory environment

- Comprehensive solution, providing enterprise-grade contact compliance so they can confidently expand their marketing footprint

- Platform flexibility, delivering compliance protection regardless of tech requirements

Want to read the full case study for more insight? Get your copy here.

Related Posts

Background Prominent payment solutions provider faced challenges managing regulatory compliance amid significant growth and expansion Considered solutions like Gryphon ONE for Compliance too costly and restrictive to outreach Developed an…

Company Spotlight Background Fortune 100 Property & Casualty insurance carrier struggled with manual lead processing Faced issues with contact compliance and operational efficiency Needed a centralized, automated solution for lead…

Company Spotlight Background A leading U.S. financial institution catering to millions of customers nationwide underwent organizational restructuring across multiple business units Resources and teams were merged to support future initiatives …