Below is a recap of the essential regulatory updates for contact compliance professionals for October.

This is a marketing blog and is not intended, nor should it be interpreted, as legal advice. Please seek legal counsel for full interpretations of all rules and laws outlined in this blog.

How the FCC’s 2025 Telemarketing Overhaul Could Transform Your Contact Compliance & Call Center Strategy

The recently introduced Federal Communications Commission (FCC) “Call Branding” Further Notice of Proposed Rulemaking (FNPRM) proposes an overhaul of telemarketing and robocall regulations, including significant changes with key implications for telemarketers performing calling and texting outreach, call centers, and the broader marketing industry. These changes aim to simplify rules while addressing technological advancements and consumer protection concerns.

A key objective from FCC Chairman Carr’s “Delete, Delete, Delete” initiative includes addressing the problem of illegal foreign robocalls by requiring identification and increasing transparency on the call path from international origins to the consumer’s handset.

The new Call Branding FNPRM proposes the following:

- Call Abandonment Rules: Eliminates the 15 seconds/4 rings minimum rule and the 3% abandonment rate cap. Could allow more flexibility for telemarketers managing unanswered calls but will require self-regulation to avoid damaging consumer experience (para 95-102).

- Caller ID Enhancements: Although carriers are not required to display a check mark to indicate call verification, if they choose to do so, they must include caller ID. The FCC is also exploring “Rich Call Data” to enhance call transparency and security (para 30-37).

- Originating Provider Verification: Providers must verify the accuracy of caller ID information, with attention to all links in the call chain, including resellers and those using branded calling (para 43-47).

- Company-Specific Do-Not-Call (DNC) Rules: The FCC proposes deleting the company-specific DNC rules that require callers to record and maintain subscriber do-not-call requests separately from the National DNC Registry. The rationale is that the National DNC Registry and other anti-robocall rules, including consent revocation, collectively provide sufficient consumer protection while eliminating redundant and burdensome compliance requirements (para 94-100). The FCC is seeking public comment on whether consumers still need company-specific DNC opt-outs or if relying solely on the National DNC Registry is adequate, as well as the implications for automated opt-out mechanisms (para 97-101).

- Foreign Call Identification: Incoming and outgoing calls from outside the U.S. will be required to transmit a visible indicator to the consumer’s device, showing the call’s foreign origin. This is expected to significantly impact offshore call centers because calls labeled as “foreign” often face near-zero answer rates, posing severe challenges for industries relying on such centers, including debt collection, financial services, healthcare, and lead generation (para 68-86). See also Keep Call Centers in America Act.

- Revoke All/Consent Revocation: The FCC granted a one-year extension, delaying the enforcement of the “revoke-all” rule until April 2026, which would require organizations to apply a consumer’s revocation of consent across all their lines of business. Other revocation requirements, such as honoring “STOP” texts, have remained effective since April 2025. Industry organizations (including ACA and Bankers) have been actively challenging the “revoke all” rule throughout 2025, trying to further delay or eliminate it altogether.

Potential Industry Impact:

- Offshore Call Centers: The mandatory labeling of foreign-origin calls as such is a game-changer, likely causing a dramatic drop in answer rates and forcing many offshore operations to reconsider U.S. campaigns.

- Financial Services, Healthcare, and Debt Collection: These high-regulation industries will face intensified scrutiny, with compliance requiring substantial system upgrades and strategic shifts toward domestic or branded calling.

- Call Centers and Marketing Firms: Must adapt to new calling practices, enhanced ID verification procedures, and manage consumer consent meticulously to avoid enforcement risks.

Staying ahead of these changes is critical for maintaining compliance and consumer trust.

For detailed analyses, see the MS Law Group overview and Privacy World commentary.

Senate Advances Foreign Robocall Elimination Act, Expanding Oversight and Enforcement Tools

The bipartisan Foreign Robocall Elimination Act (S.2666), co-sponsored by Senators Ted Budd (R–N.C.) and Peter Welch (D–Vt.), has cleared the Senate Commerce, Science, and Transportation Committee, marking the first robocall-focused legislation to advance since 2020. The measure would create a public-private task force within the Federal Communications Commission (FCC) to identify, trace, and disrupt foreign robocalls targeting U.S. consumers.

The task force, composed of representatives from the FCC, Federal Trade Commission (FTC), Department of Justice (DOJ), and experts from the telecom and analytics sectors, would coordinate enforcement and develop strategies to block unlawful international spoofing activity. Senators emphasized that foreign origin robocall traffic has increased dramatically in recent years, defrauding vulnerable consumers and threatening public trust in communications systems.

During markup, the committee adopted four key amendments by Senator Ed Markey (D–Mass.), co-sponsored by Senators Ben Ray Luján (D–N.M.) and John Thune (R–S.D.), designed to strengthen tracebacks and accountability:

- Robocall Database Bond: Requires telecom providers to post up to a $100,000 bond to appear in the Robocall Mitigation Database, raising the barrier for repeat offenders.

- Traceback Enhancement Addition: Incorporates the Robocall Traceback Enhancement Act, extending liability protections for telecom firms that assist investigations.

- Expanded Reporting: Adds provisions directing the FCC to assess the effects of publishing private traceback data on privacy and enforcement.

- Clarified Reporting Terms: Refinements to define “report” and ensure uniform agency reporting practices.

Endorsed by AARP and USTelecom, the legislation builds upon the TRACED Act by formalizing ongoing cooperation between industry and government to target cross-border calling scams. Once enacted, it would give the FCC and DOJ enhanced collaborative authority to curb overseas robocall schemes that exploit U.S. telecom networks.

Washington’s CEMA Expands from Emails to Texts

Washington’s Commercial Electronic Mail Act (CEMA), a statute originally aimed at deceptive or misleading email marketing, is increasingly being leveraged by plaintiffs to challenge text-based referral and promotional campaigns.

CEMA prohibits sending commercial messages with misleading subject lines or transmission data and, unlike federal CAN-SPAM, allows private rights of action with significant statutory damages. That combination has led to a wave of class actions targeting national brands for marketing practices once considered routine.

In Bottoms v. Block, Inc., consumers alleged that Block’s Cash App “Refer a Friend” program generated unsolicited referral texts in violation of CEMA and the state Consumer Protection Act. Block agreed to a $12.5 million settlement to resolve the claims.

Parallel lawsuits, including those against Home Depot and Skechers, focus on alleged misleading or unauthorized emails.

Plaintiffs’ recent arguments that CEMA covers texts as well as emails broaden exposure for companies using digital outreach, referral links, or automated messaging.

CEMA actions complement but extend beyond the FCC’s Telephone Consumer Protection Act (TCPA) and FTC’s Telemarketing Sales Rule (TSR), underscoring the need for documented consent, message accuracy, and clear opt-out controls across every digital channel.

Collections Corner

Updates on evolving debt collection & contact compliance rules.

1. One Day Really Does Make a Difference – Debt Collectors Beware

A class action filed in the Middle District of Florida alleges a collector placed a prerecorded call to a wireless phone in Florida, without consent, one day after receiving a certified “cease communication” request. One phone call resulted in a class action lawsuit! Here are the details:

- Violations: The complaint cites violations of the Fair Debt Collection Practices Act’s (FDCPA) cease-contact rule, the TCPA’s prerecorded call provisions (restrictions on consent and prerecorded content), and Florida’s Florida Consumer Collection Practices Act (FCCPA). It also supports the FTC’s TSR prohibition on abusive or repeated contact.

- Collectors must document receipt timing and system holds to block further activity.

- Affected industries: Third-party debt collectors, recovery vendors, and financial-services providers using automated dialing or messaging.

- Business risk: Potential class-wide statutory damages under multiple statutes, signaling the need for strict synchronization between cease-request intake and dialer suppression systems.

2. New York City Debt Collection Rule Still Looming

NYC’s fiercely debated, then modified, Digital Communications Rule (amending 6 RCNY § 2-190), initially effective December 1, 2024, was extended to October 1, 2025. While that date has come and gone, the rule is still pending; the adopted rule summary states the DCWP will provide at least three-months’ notice before the rules go into effect. The NYC’s Department of Consumer and Worker Protection (DCWP) finalized amendments require:

- One-time digital outreach: Collectors may send one initial email, text, or social message only to request the consumer’s consent for ongoing digital communications. No further digital contact may occur until explicit permission is granted.

- Frequency limits: Caps apply to all channels (calls, texts, emails, and in-app messaging), preventing excessive or harassing contact regardless of medium.

- Expanded record-keeping: Agencies must maintain detailed communication logs (including oral, written, and electronic interactions) and retain them for at least three years.

- Verification holds: All collection activity must pause upon receipt of a dispute until the debt is validated.

- Enhanced medical and time-barred debt restrictions: Strengthened disclosure and handling requirements mirror broader consumer-protection objectives.

Debt collectors, servicers, creditors, and any entity using digital outreach to NYC consumers must implement systems that track multi-channel outreach, capture and store digital consent, and suppress contact until permission is verified.

These local amendments complement – not contradict – federal standards. The FTC’s TSR addresses unfair or deceptive telemarketing practices, while the FCC’s TCPA governs consent for autodialed/prerecorded calls and texts. NYC’s rule extends that consent framework to all digital communications, filling gaps not explicitly covered by federal law.

3. Maryland Issues Collection Agency Advisory

On October 14, 2025, the Maryland Department of Labor issued a Collection Agency Advisory clarifying three new Health-Care Collection laws effective October 1, 2025: HB428, HB1020, and HB268.

Key points:

- Collectors must provide detailed itemization and notice before litigation or credit reporting.

- Hospitals must ensure charity-care screening before referral to collections.

- Agencies cannot place or sell medical debt until statutory prerequisites are met.

Verification and disclosure obligations required of Health-care providers, revenue-cycle vendors, and debt buyers handling medical portfolios may delay or restrict collection outreach.

It should be noted that these new rules complement TSR’s deceptive-practice prohibitions and mirror TCPA’s emphasis on informed consumer communication. As such, non-compliance can trigger license actions or restitution under state law.

Coming Soon: FCC Sets “Do-Not-Originate” Voice Provider Blocking Deadline of December 15, 2025

The Federal Communications Commission (FCC) has adopted new rules requiring voice service providers to block calls from numbers listed on the Do-Not-Originate (DNO) list by December 15, 2025. The Final Rule published in the Federal Register expands the FCC’s “Advanced Methods to Target and Eliminate Unlawful Robocalls” framework, mandating that all originating and gateway providers block traffic using invalid, unallocated, or spoofed caller IDs identified through the DNO list.

Telecommunications carriers, call centers, VoIP platforms, etc. using legitimate outbound numbers must ensure those numbers are properly registered and not mistakenly flagged as DNO to avoid blocked calls or service disruptions.

Customer Advisory: Gryphon AI and the Government Shutdown

The federal government officially shut down on October 1, 2025, temporarily pausing critical regulatory services from agencies like the FTC and FCC, including the National Do Not Call Registry.

Gryphon AI remains fully committed to supporting your compliance needs. We maintain the most recent version of the FTC’s National Do Not Call Registry on hand, ensuring your calling lists stay fully compliant during this period.

Please note that due to the shutdown, no new Do Not Call complaints are being accepted, and none are being processed. Additionally, the ability to register or renew Subscription Account Numbers (SANs) is suspended until further notice.

Other federally mandated contact compliance datasets such as the Reassigned Number Database (RND), Ported Wireless, and others managed by third parties, remain unaffected by the shutdown.

For more information, see the FTC’s official announcement.

Regulatory Shake-Up: CFPB Operations Expected to Cease Within 90 Days

According to multiple reports, including Law360 and AccountsRecovery.net, Office of Management and Budget (OMB) Director Russell Vought has announced plans to wind down and close the Consumer Financial Protection Bureau (CFPB) within two to three months. The move follows ongoing debates about the Bureau’s constitutionality and funding authority.

As detailed in Law360’s follow-up coverage, federal officials are reviewing how enforcement and supervision responsibilities could be redistributed to other agencies – mentioned specifically is the Federal Trade Commission (FTC) – “Chris Mufarrige, director of the Federal Trade Commission‘s Bureau of Consumer Protection, recently indicated that the FTC will return to its “historically important role” in overseeing the consumer finance industry, emphasizing the FTC’s jurisdiction to enforce laws relating to data privacy, including the Fair Credit Reporting Act and the Gramm-Leach-Bliley Act, and the FTC Act’s prohibitions on unfair or deceptive business practices.” Meanwhile, ACA International noted that the CFPB has already ceased public reporting on nonbank supervision decisions – signaling a potential operational drawdown.

A closure or restructuring could alter oversight for financial institutions and collection entities, particularly regarding Unfair, Deceptive, or Abusive Acts of Practices (UDAAP), consumer-disclosure, and complaint-response requirements.

Transition uncertainty may delay regulatory guidance and enforcement consistency across the credit, lending, and recovery industries.

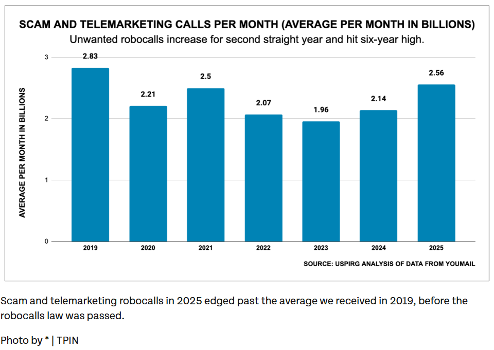

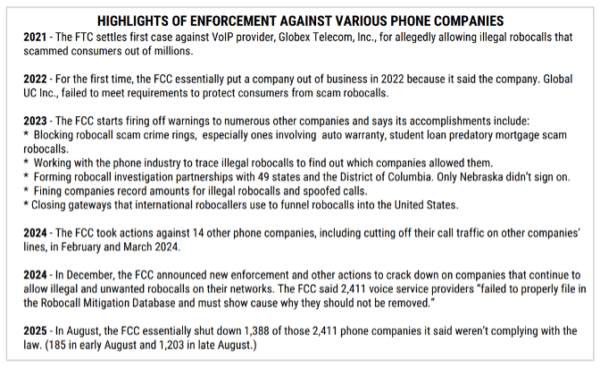

Telemarketing Risk Rebounds: Data Shows Robocalls Are Back in Force

Spam and scam robocalls are no longer just a nuisance – they’re back at a six-year high and creating real risk for organizations that rely on voice and text outreach. According to the latest report from U.S. PIRG Education Fund, the monthly average of unwanted calls now stands at 2.56 billion, up from 2.14 billion in 2024. Alarmingly, fewer than half of U.S. phone companies have fully installed the required caller-authentication tech, according to the Federal Communications Commission’s (FCC) robocall mitigation database and that’s after 1400+ violators were shut down.

For businesses with outreach programs, this trend has implications: increased fraud exposure, reputation risk, carrier-chain weaknesses, and potential regulatory scrutiny. The PIRG “Ringing in Our Fears 2025” report outlines how scam volumes are rising and how the carrier network is not yet keeping pace. Per the report, victims of scam calls lost an average of $3,690 in the first half of 2025. Victims of scam texts lost an average of $1,452 in the first half of 2025.

What can you do? Start with the consumer-tips brochure from PIRG. Then review your outreach ecosystem: vendor compliance, call/text authentication, and lead-list hygiene. This resurgence in robocalls isn’t just a numbers issue – it’s an operational and compliance challenge. Monitoring it, adapting to it, and building resilience should be top of mind.

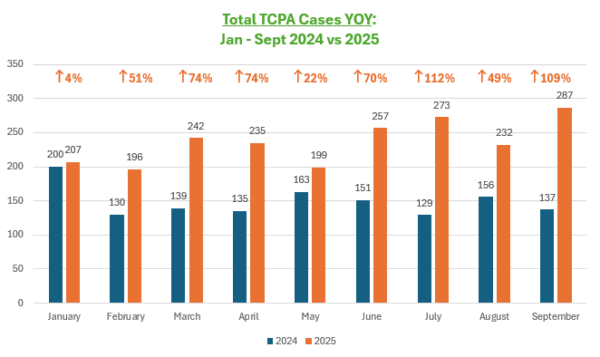

2025 Year-to-Date TCPA Litigation Continues to Trend Upwards

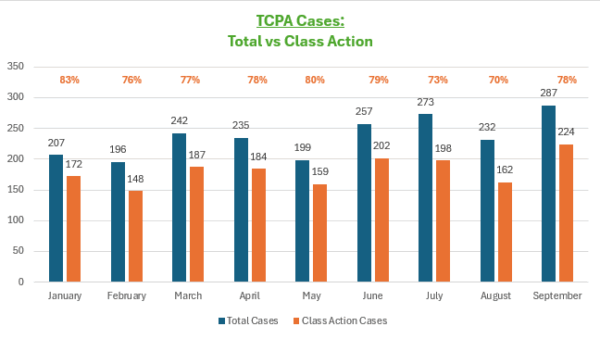

Through the first three quarters of 2025 (January–September), the volume of telemarketing litigation has continued to rise, with class action lawsuits remaining the predominant form of legal action. A total of 2128 Telephone Consumer Protection Act (TCPA) cases have been filed, marking a 58% increase compared to the 1348 cases reported during the same period in 2024.

Year-to-date class action cases averaged 77% of all TCPA filings, highlighting a continued trend toward collective action and the pursuit of increased negotiating leverage against major defendants.

Even with the private right of action provision in TCPA, the dramatic surge toward class action litigation offers an additional advantage for class members by providing access to resources and legal expertise they might otherwise lack. By participating in a class action, members not only seek justice for their own grievances but also help deter future misconduct, benefiting both themselves and the wider public.

As a company utilizing telemarketing (calls or texts), be vigilant about regulatory developments and how they impact your business – the last year has been all about ‘consent’, so be sure you are honoring it correctly, timely, and without fail.

Source: Web Recon.

The AI LEAD Act: Treating AI as a Product

The bipartisan Aligning Incentives for Leadership, Excellence, and Advancement in Development Act (AI Lead Act), introduced by Senators Josh Hawley (R-MO) and Dick Durbin (D-IL) on September 30, 2025, would formally classify artificial intelligence systems as “products.” This change applies traditional product-liability standards to AI developers, allowing individuals and state attorneys general to pursue claims when an AI system causes injury, defamation, or financial harm. As noted in the Senate Judiciary Committee’s summary, the measure aims to “align innovation with accountability,” ensuring AI tools are built and tested with safety in mind.

According to ACA International’s coverage, the bill complements other federal AI proposals that balance innovation with consumer protection.

The National Law Review identifies shortcomings: “Most notably, the Act would apply retroactively to any action commenced after its enactment, regardless of when the underlying alleged harm and related alleged conduct occurred.”

Organizations using AI in messaging, customer service, or decisioning, must verify accuracy and fairness to avoid “defective product” liability.

The Act aligns with the FTC’s TSR and FCC’s TCPA, reinforcing accountability for deceptive or unauthorized AI-driven contact.

Customer Alert: New York State of Emergency Issued through November 23, 2025

Consistent with prior communications, Executive Orders declaring disaster emergencies in the State of New York trigger telemarketing restrictions under the Nuisance Call Act.

The Nuisance Call Act makes it unlawful for any telemarketer to make unsolicited telemarketing sales calls to areas of the state under an emergency declaration.

Executive Order 53 declaring a State Disaster Emergency in the State of New York arising from concerns about hazardous conditions due to coastal storms has been issued, effective through November 11, 2025.

Executive Order 47.11 declaring a State Disaster Emergency in the State of New York arising from an illegal and unlawful strike by correction officers, was extended to November 23, 2025.

Gryphon AI has extended State of Emergency blocks for New York to November 23, 2025, to ensure compliance with the above Executive Orders.

November 2025 Holiday Solicitation Bans

Please be aware of the following U.S. holiday telephone solicitation bans for the month of November 2025:

- On November 11, 2025, Alabama, Louisiana, Nebraska*, Pennsylvania, Rhode Island, and Utah prohibit unsolicited sales and marketing calls to residents in observance of Veterans Day.

- On November 27, 2025, Alabama, Louisiana, Nebraska*, Pennsylvania, Rhode Island, and Utah prohibit unsolicited sales and marketing calls to residents in observance of Thanksgiving Day.

- On November 28, 2025^, Nebraska* and Pennsylvania prohibit unsolicited sales and marketing calls to residents in observance of Thanksgiving, Friday After Holiday.

Other holidays may be proclaimed by the Governor in each state throughout the year.

*Nebraska does not prohibit calls on Sundays or legal holidays; however, it does restrict the use of prerecorded messages to 1 pm to 9 pm on these days (subject to certain exceptions).

^As of this date of publication, no proclamation from the LA Governor has been declared for November 28, 2025, as Acadian Day for purposes of DNC.

Please be aware of the following Canadian holiday telephone solicitation bans for the month of November 2025:

- On November 11, 2025, unsolicited sales and marketing calls to residents of the following provinces and territories are prohibited in observance of Remembrance Day: Alberta, British Columbia, New Brunswick, Northwest Territories, Nunavut, Prince Edward Island, Saskatchewan, and Yukon.

Gryphon AI has updated its existing service parameters to reflect these solicitation bans.

About Gryphon AI

Staying updated with the latest regulatory changes is crucial for any enterprise aiming to minimize risk and maximize reach. Gryphon AI is the only automatic, real-time, intelligent contact compliance solution on the market that delivers compliant, real-time intelligence into every customer conversation.

With Gryphon AI, enterprises can stay ahead of the regulatory curve and efficiently manage all regulatory changes, ensuring seamless compliance and operational excellence.

To learn more about how Gryphon AI can help you manage these updates, reach out to us today.

Related Posts

Below is a recap of the essential regulatory updates for contact compliance professionals for January. This is a marketing blog and is not intended, nor should it be interpreted,…

Below is a recap of the essential regulatory updates for contact compliance professionals for December. This is a marketing blog and is not intended, nor should it be interpreted, as legal…

Below is a recap of the essential regulatory updates for contact compliance professionals for November. This is a marketing blog and is not intended, nor should it be interpreted,…