Below is a recap of the essential regulatory updates for contact compliance professionals for January.

This is a marketing blog and is not intended, nor should it be interpreted, as legal advice. Please seek legal counsel for full interpretations of all rules and laws outlined in this blog.

FCC Delays “Revoke All” Rule to January 31, 2027

On January 6, 2026, the Federal Communications Commission’s (FCC) Consumer and Governmental Affairs Bureau extended the effective date of the Telephone Consumer Protection Act’s (TCPA) “revoke all” rule (47 C.F.R. § 64.1200(a)(10)) from April 11, 2026, to January 31, 2027.

This rule requires callers to treat a consumer’s revocation request (e.g., “STOP”) for one robocall/robotext as applying to all future calls/texts from that caller, even unrelated ones, and across all channels. Other revocation rules (e.g., honoring “reasonable” methods within 10 business days) remain in effect since April 2025.

Law360 reports the agency “heeded the call of companies asking it to push a deadline for complying with a rule that makes it easier for people to opt out of robotexts.”

The FCC cites “good cause” for the delay, responding to industry waivers citing implementation burdens (e.g., utilities needing system overhauls). The FCC seeks comments through February 3 on modifying or eliminating the rule amid ongoing rulemaking.

Key takeaway: Telemarketers gain 9+ months of breathing room to update or refine consent flows/DNC processes and systems, avoiding premature cross-channel opt-outs. Keep prioritizing current revocations, focus on honoring revocations as soon as possible (ideally real-time), and monitor FCC developments closely.

Duane Morris Class Action Review 2026: What It Means for Your TCPA and FDCPA Compliance

Duane Morris’ 2026 Class Action Review breaks down over 1,761 court rulings from 2025, covering 23 litigation areas, showing a record $70 billion in settlements, and courts approving 68% of class actions. For telemarketers and debt collectors, TCPA cases led with $34.77 million in major payouts from robocalls and texts, and cases like $9.7 million against Freedom Financial for debt collection calls.

Highlights:

- TCPA suits surged on consent issues and state “mini-TCPA” laws, plus circuit court splits that let plaintiffs pick favorable venues.

- TCPA settlements topped prior years (e.g., $20M Realogy robocalls, $12.5M Block, Inc. spam texts, $7.5M Zale Delaware robocalls), focusing on DNC violations, especially wrong numbers.

- FDCPA paired with FCRA ($54.5M settlements) hit hard on inaccurate reporting and dispute handling.

- Filings jumped to 13,000+ federally with 36 new cases daily.

- New administration stopped filing disparate impact lawsuits (where neutral policies unintentionally harm protected groups), shifting enforcement power to private plaintiffs resulting in unpredictable class actions for companies, including telemarketers facing TCPA claims.

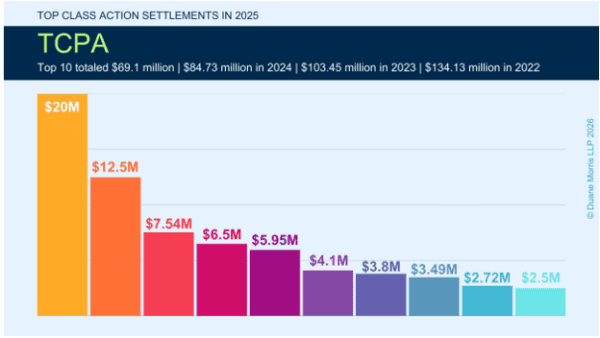

TCPA Top Class Action Settlements in 2025

There were several multi-million class-wide TCPA settlements in 2025. The top 10 settlements totaled $69.1 million. This constituted a slight decrease from the previous year when the top ten class action settlements totaled $84.73 million.

Source: Duane Morris Class Action Review 2026

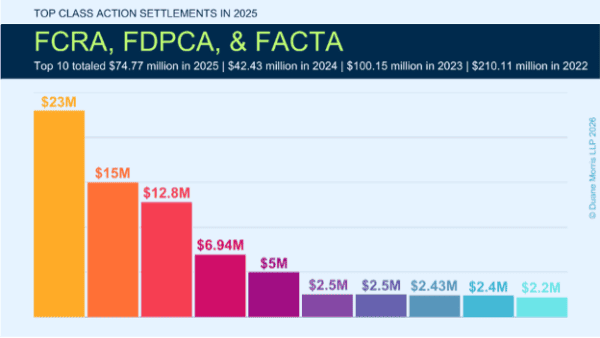

FCRA, FDPCA, FACTA Top Class Action Settlements in 2025

In 2025, the top ten FCRA, FDPCA, and FACTA settlements totaled $74.77 million. This was a significant increase from the prior year when the top ten class action settlements totaled $42.43 million.

Source: Duane Morris Class Action Review 2026

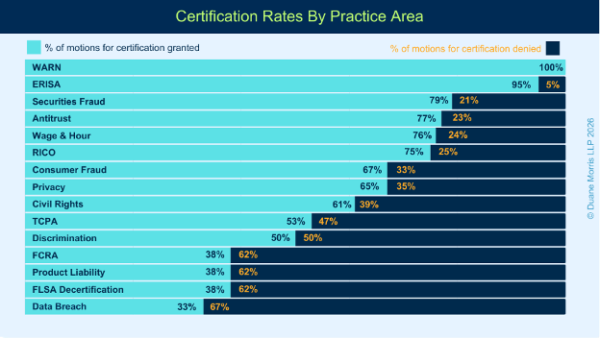

Class Action Certification Rates by Practice Area

TCPA Class Certification rates for 2025 were 53% certified, 47% denied, increasing significantly from 2024, at 37% certified and 63% denied.

FCRA Class Certification rates for 2025 were 38% certified, 62% denied, staying flat compared to 38% and 62% for 2024, respectively.

Duane Morris Class Action Review 2026

Review your calling scripts and DNC processes today, and build ironclad court-defensible consent by documenting who, what, when, and how – with independent proof ready for any challenge.

As a leader in the Contact Compliance industry, Gryphon AI can help.

Click here to order the full 748-page report.

FCC’s New Robocall Rules: What Changes on February 5

The Federal Communications Commission (FCC), with the Office of Management and Budget’s (OMB) approval, tightened rules for the Robocall Mitigation Database (RMD), a public system where providers detail how they block illegal robocalls. These updates affect anyone originating or carrying outbound calls and texts across U.S. networks. Most provisions take effect February 5, 2026, with your first annual recertification due by March 1.

The capture and centralization of robocall blocking plans make provider filings more reliable, ensuring outbound calls and texts reach their destination without unexpected blocks.

What Providers Must Do

- Recertify annually: Starting February 1, 2026, confirm your RMD filing is accurate and up to date by March 1 each year. This includes validating your STIR/SHAKEN implementation/authentication status.

- Timely updates are mandatory: Report any changes (like ownership or contact info) in RMD or CORES within 10 business days or face up to $10,000 fines.

- Login security upgrade: Multi-factor authentication is now required to access RMD, helping prevent unauthorized edits.

Bigger Fines and Easier Oversight

Expect stricter enforcement and understand how non-compliance gets expensive:

- False, outdated, inaccurate info: $10,000 base fine per violation.

- Late updates: $1,000 per violation accrued daily until corrected.

The FCC also launched a new email (RMD-Reporting@fcc.gov) so others can flag weak filings, making compliance more visible to peers and regulators.

Why This Matters for Outbound Programs

Carriers check the RMD before accepting your outbound calls and texts. Weak or outdated mitigation plans can get your traffic rejected outright – halting campaigns in their tracks and triggering FCC enforcement. For high-volume marketers and debt collectors, this means lost connections and revenue.

Next Steps

Review your RMD filing, test your update processes, and prepare for the February 1- March 1 recertification window. Gryphon AI automates pre-call compliance screening to keep your outreach flowing without interruption. New FAQs also guide foreign providers and affiliates through proper filing.

Federal TCPA Ambiguity, State-Level Clarity: The New Reality for Text Campaigns

Two federal appeals courts recently narrowed Telephone Consumer Protection Act (TCPA) exposure for certain outbound texts, offering relief for high-volume campaigns, but state rules like Texas SB140 and the Federal Trade Commission’s (FTC) Telemarketing Sales Rule (TSR) enforcement keep risks high.

Ninth Circuit: Texts Are “Calls,” But Texts with Videos Are Safe, Right?

The Ninth Circuit ruled in a split decision in the case of Howard v. RNCC that texts with embedded videos (needing a “play” tap to hear prerecorded audio) do not violate TCPA’s artificial/prerecorded call ban. The court focused on call “initiation”.

However, Texas SB140 explicitly covers these as “telephone solicitations” (SMS/MMS/images for sales), requiring registration (for some)/disclosures unless consent-based (effective September 1, 2025). Violations trigger DTPA private actions with $500–$5K per incident (treble for intent).

Seventh Circuit: Narrower “Solicitation” Definition

The Seventh Circuit limited “telephone solicitation” to calls/texts urging purchases (free consults exempt from Do Not Call rules).

Texts Aren’t Always “Calls”: Florida Federal Split

Florida federal courts remain split post-McKesson on whether texts qualify as “telephone calls” under TCPA and DNC rules:

- N.D. Fla. (Davis v. CVS, Aug. 2025) and M.D. Fla. (El Sayed v. Naturopathica, Oct. 2025) ruled no, plain texts ≠ “calls,” dismissing DNC claims.

- S.D. Fla. (Bosley v. A. Bradley Hosp.) held yes.

- S.D. Fla. (McGonigle v. Pure Green) stayed discovery pending resolution.

Texts may not qualify as “calls” under TCPA’s precise wording. Pure texts increasingly dodge TCPA/DNC/autodialer claims while FTSA separately requires consent/”STOP”.

Key Takeaways

These rulings curb TCPA suits on video texts/non-sales outreach, but the federal/state patchwork persists. Texts face surging lawsuits across states. What you can do:

- Get written opt-in consent before sending (required by TCPA/FTSA).

- Certify your files against Do Not Call lists (federal and state).

- Honor opt-outs immediately (stop/unsubscribe within 10 days, however ideally sooner, while ‘real time’ is best case).

- Use multi-state screening tools.

Gryphon AI can help with automated compliance checks before every message deploys.

CFPB’s Wild Ride: Cash Crisis, Leadership Shuffle, and What’s Next

The Consumer Financial Protection Bureau (CFPB) (the government’s consumer finance watchdog) nearly shut down in late 2025 amid a funding standoff, but got a last-minute lifeline.

Quick timeline:

- November: President Trump nominates Office of Management & Budget (OMB) energy representative Stuart Levenbach for director and later confirms Vought remains in place through August 2026.

- December: Court forces Vought to beg the Federal Government for cash.

- January 9: Vought requests $145M (“under protest”)

- Jan 16: Fed pays up with no furloughs.

Vought hit pause on enforcement; states Attorneys General jumped in with Zelle probes, BNPL (Buy Now Pay Later) scrutiny, and DEI takedowns. Ex-CFPB head Rohit Chopra now advises Democratic AGs’ Association Consumer Protection & Affordability Working Group – state-level CFPB 2.0.

2026 Outlook

Levenbach confirmation looms. Expect lighter federal oversight and heavier state patchwork. Compliance tip: Track AG actions, not just D.C

Collections Corner

Updates on evolving debt collection and contact compliance rules:

- NY’s Fair Business Practice Act Takes Effect 2/17/26

- AI Introduces New Debt Collection Risk

- Debt Collections Firm Facing Wrong Number Violations

- Judge Rejects Inability to Prove Automated Dialing

- Comcast Hit with $1.5 Fine for Debt Collection Vendor Breach

NY’s Fair Business Practices Act Takes Effect Feb 17, 2026

New York’s FBPA (SB S8416) kicks in soon, strengthening the Attorney General’s ability to crack down on debt collection tactics. It expands consumer protections under unfair, deceptive or abusive practices (UDAAP) with enhanced remedies for violations. For outbound callers targeting New Yorkers, now’s the time to audit your scripts, disclosures, and processes to stay ahead of potential investigations.

AI Introduces New Risks in Debt Collections

AI tools promise smarter collections but bring fresh TCPA headaches like proving consent for synthetic voices or automated decisions. Regulators worry about “wrong number” hits from bad data or unverified lists. Be sure to test AI outputs, log consents, and pre-screen every call to dodge lawsuits.

Debt Collections Firm Faces Wrong-Number Violations (High Risk)

TrueAccord, a debt servicer, has been hit with a TCPA class action for allegedly autodialing wrong numbers without verifying debtors first. Plaintiffs say this violates rules against calling non-consenting parties. Gryphon’s RND offering flags high-risk numbers before dialing, reducing exposure to fines that can exceed $1,500 per call and minimizing litigation costs while building defensible documentation.

Judge Rejects TCPA Claims Without ATDS Proof

A Florida judge threw out TCPA allegations because plaintiffs couldn’t prove an automatic telephone dialing system (ATDS), stating high call volumes alone aren’t enough proof. Defendants rejoice: Document your dialer technology to win these motions early, no guesswork needed.

Comcast Hit with $1.5M Fine for Vendor Breach

Comcast paid the FCC $1.5 million after its debt collection vendor Financial Business & Consumer Solutions (FBCS) leaked 237,000 customers’ data (SSNs and more). Oversight failure stung. Lesson for businesses: Vet vendors rigorously, enforce TCPA/data clauses in contracts – don’t let partners sink you.

Federal AI Pushback vs. State Patchwork

President Trump’s December 11, 2025, Executive Order “Ensuring a National Policy Framework for Artificial Intelligence” aims to curb state AI laws, creating an AI Litigation Task Force to challenge those conflicting with federal dominance goals (EO 14365). Building on the failed 10-year moratorium in the July 2025 budget bill, it signals minimal federal burden amid state rushes.

Why this matters in telemarketing:

“Because AI calls fall within the ambit of the TCPA, certain AI calls made to consumers, without their prior express consent, violate the TCPA.”

- Colorado AI Act: “High-risk” AI for “financial/lending services” (eff. June 2026) mandates impact assessments/disclosures; AI lead scoring or predictive dialing qualifies if denying services/opportunities.

- Texas TRAIGA (Jan. 2026): Bans discriminatory AI; requires AI interaction disclosure. AI voice agents/chatbots in outbound must disclose “this is AI,” avoid “dark patterns” in opt-outs. AG fines up to $200K.

- Utah AI Policy Act: GenAI disclosure in “high-risk” financial interactions (e.g., advice via AI calls/texts). AG fines up to $2,500/violation.

Recommendation: Disclose AI use early (“This is an AI assistant…”); audit for bias in scrubbing/scoring to dodge discrimination claims in addition to TCPA.

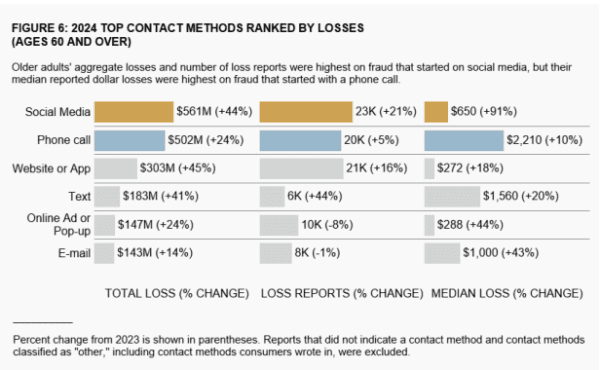

FTC Publishes 2024-2025 Protecting Older Consumers: Telemarketing Risks for Seniors

In a report by the Federal Trade Commission, Seniors (60+) reported $2.4B lost to fraud in FY2025 (4x since 2020). Investment scams via social media top the list, but telemarketing schemes like debt relief (“75% reduction”) and tech support impersonations drew FTC enforcement fire.

Fraud against seniors via phone call was up 24%, and text and email were up as well with 41% and 14% respectively.

Telemarketing Enforcement & Reimbursement Highlights

- FTC sued Accelerated Debt for targeting older veterans with fake bank/government impersonations and illegal advance fees/DNC violations.

- Paddle tech support robocalls cost seniors millions; Walmart money transfers enabled scams.

- $311M in FTC refunds FY25 from debt/tech/health pitches hitting older adults.

What Businesses Can Add to Their Compliance Playbook

- Implement pre-contact script screening scans on outbound content for high risk phrases like “eliminate debt,” “75% reduction”, or “government relief” (e.g. block before dialing).

- Honor consent revocation immediately and systematically.

- Monitor risk and track FTC trends and adjust campaigns to dodge impersonation traps.

- Maintain audit-ready records for every outbound call/text to prove TSR/TCPA compliance.

FTC’s senior focus means higher scrutiny on outbound communication. Gryphon AI can help you screen, document, and pivot before the next enforcement wave hits.

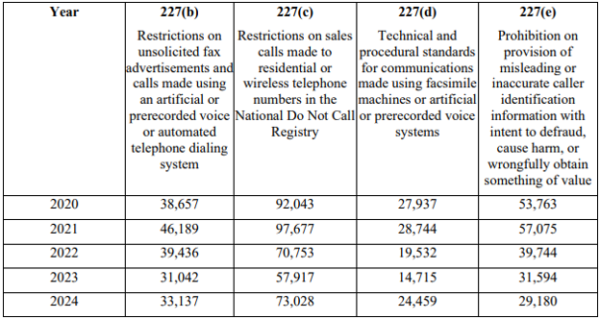

FCC’s 2025 Robocall Report to Congress Signals Ongoing Enforcement Focus

The Federal Communications Commission’s (FCC) Dec 23, 2025 report to Congress, analyzes complaints during 2020-2024 and enforcement through 2024 under the TRACED Act, and details 2024 activity against illegal robocalls, spoofing, and AI abuses, which are key for outbound phone/text operations.

Complaints recorded by the FCC alleging violations; note one complaint may contain multiple violations:

Highlights for Businesses:

- Consumer complaints: 33,137 robocalls (227(b)), 73k DNC (227(c)), steady but targeted.

- Enforcement: $6M forfeiture on Steve Kramer for AI deepfake robocalls spoofing caller ID.

- Robocall Mitigation Database (RMD)/STIR SHAKEN: December rules mandate annual recertifications and filing fees for RMD; November rules limit third-party signing to providers’ own certificates.

- Telephone Consumer Protection Act (TCPA): Consent revocation modified from 30 days to ≤10 days by any reasonable means; AI voices ruled robocalls; Do Not Originate (DNO) text blocks.

The FCC’s annual robocall report underscores persistent threats from AI-generated voices and spoofing, with 33k+ complaints in 2024. Enforcement hit hard, fining Steve Kramer $6M for deepfake Biden robocalls to NH voters which is illegal under TCPA and Truth in Caller ID Act.

New RMD rules require annual recertifications and fees to ensure accurate filings; providers face higher fines for inaccuracies. STIR/SHAKEN tightened – use your own certificates for signing, even with third parties. Revoke consents within 10 business days via any reasonable method; robotexts from DNO lists now blocked.

Outbound callers must adapt: Certify against Reassigned Numbers Database (RND) regularly, document collected consent meticulously andmonitor RMD status. As AI threats evolve, FCC vows continued action – compliance remains paramount.

January 2026 Holiday Solicitation Bans

Please be aware of the following U.S. holiday telephone solicitation bans for the month of February 2026:

- On Monday, February 16, 2026, the states of Alabama, Nebraska*, Pennsylvania, Rhode Island, and Utah prohibit unsolicited sales and marketing calls in observance of President’s Day.**

- On Tuesday, February 17, 2026, the state of Alabama (Baldwin and Mobile Counties only) prohibits unsolicited sales, and marketing calls in observance of Mardi Gras.

Other holidays may be proclaimed by the Governor in each state throughout the year.

*Nebraska does not prohibit calls on Sundays or legal holidays; however, it does restrict the use of prerecorded messages to 1pm to 9pm on these days (subject to certain exceptions).

**At the time of this publication, the Governor of Louisiana has not declared President’s Day a DNC holiday.

Please be aware of the following Canadian holiday telephone solicitation bans for the month of February 2026:

- On Monday, February 16, 2026, unsolicited marketing calls are prohibited to residents of the provinces of Alberta, British Columbia, New Brunswick, Ontario, and Saskatchewan in observance of Family Day.

- On Monday, February 16, 2026, unsolicited marketing calls are prohibited to residents of the province of Prince Edward Island in observance of Islander Day.

- On Monday, February 16, 2026, unsolicited marketing calls are prohibited to residents of the province of Manitoba in observance of Louis Riel Day.

- On Monday, February 16, 2026, unsolicited marketing calls are prohibited to residents of the province of Nova Scotia in observance of Heritage Day.

Gryphon AI has updated its existing service parameters to reflect these solicitation bans. Please contact us with any questions at 866-366-6822.

New York State of Emergency Issued Through February 22, 2026

Consistent with prior communications, Executive Orders declaring disaster emergencies in the State of New York trigger telemarketing restrictions under the Nuisance Call Act.

The Nuisance Call Act makes it unlawful for any telemarketer to make unsolicited telemarketing sales calls to areas of the state under an emergency declaration.

Executive Order 47.14 declaring a State Disaster Emergency in the State of New York arising from an illegal and unlawful strike by correction officers, was extended to February 15, 2025.

Executive Order 52.5 declaring a State Disaster Emergency in the State of New York arising from concerns due to Federal Actions related to vaccine access, has been issued effective through February 22, 2026.

Executive Order 55.1 related to severe winter weather extending to multiple counties, is effective through January 28, 2025.

Executive Order 56.1 and Executive Order 56.2 related to an imminent strike of nursing personnel in designated counties, threatening public health and safety, and the ability to provide critical care. Effective through February 8, 2026.

Executive Order 57 related to extreme temperatures and hazardous conditions from the winter storm, has been issued effective through February 22, 2026.

Gryphon AI has extended State of Emergency blocks for New York to February 22, 2026, to ensure compliance with the above Executive Orders.

Contact the Gryphon AI Helpdesk with any questions at 866-366-6822.

About Gryphon AI

Staying updated with the latest regulatory changes is crucial for any enterprise aiming to minimize risk and maximize reach. Gryphon AI is the only automatic, real-time, intelligent contact compliance solution on the market that delivers compliant, real-time intelligence into every customer conversation.

With Gryphon AI, enterprises can stay ahead of the regulatory curve and efficiently manage all regulatory changes, ensuring seamless compliance and operational excellence.

To learn more about how Gryphon AI can help you manage these updates, reach out to us today.

Related Posts

Below is a recap of the essential regulatory updates for contact compliance professionals for February. This is a marketing blog and is not intended, nor should it be interpreted,…

Below is a recap of the essential regulatory updates for contact compliance professionals for January. This is a marketing blog and is not intended, nor should it be interpreted,…

Below is a recap of the essential regulatory updates for contact compliance professionals for December. This is a marketing blog and is not intended, nor should it be interpreted, as legal…