Blog

Fortune 100 Insurance Giant Claims Comprehensive Contact Compliance Management

June 16, 2025Case Studies

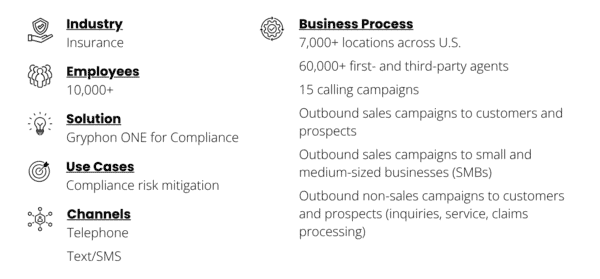

Company Spotlight

Background

- Fortune 100 Property & Casualty insurance carrier struggled with manual lead processing

- Faced issues with contact compliance and operational efficiency

- Needed a centralized, automated solution for lead processing to enforce complex compliance regulations across a vast partner and vendor network

Challenge

- Eliminating labor-intensive manual lead processing

- Ensuring compliance with DNC, TCPA and business-specific rules across 15 calling campaigns for leads flowing into their lead management platform

- Maintaining a consistent UX by integrating seamlessly with existing platforms and systems of record

- Validating platform usage and enabling rapid lead response with in-depth reporting insights

Solution

- Automated enforcement of DNC and TCPA rules within the company’s lead management application

- Centralized contact compliance management across disparate systems

- Flexible platform that supports multiple integration methods, including API and SFTP

- Detailed contact compliance validation to facilitate more efficient outreach and improve sales effectiveness

Results

- Enhanced customer experience, improved customer service, and more responsive customer engagement

- Integration with in-house lead management system ensures all leads are compliant, providing a seamless agent experience and maintaining robust audit trails across different technologies

- More effective selling, by automating lead processing and enforcing complex compliance requirements across all offices, calling agents, and campaigns

- Currently exploring future strategic initiatives, including:

- Real-time compliance assurance for live calls

- Strategies for legally reclaiming previously suppressed records to maximize reach and revenue potential

Why Gryphon AI?

- Enterprise-grade risk management, ensuring adherence to regulatory and business requirements with transparent audit reporting

- Centralized and automated compliance management, removing the burden of office-/agent-level oversight

- Seamless integration with existing systems, driving workflow continuity

- Consultative partnership, allowing the carrier to focus on selling and customer engagement with complete compliance confidence

Want to read the full case study for more insights? Download the full case study here.

Related Posts

Background Prominent payment solutions provider faced challenges managing regulatory compliance amid significant growth and expansion Considered solutions like Gryphon ONE for Compliance too costly and restrictive to outreach Developed an…

Company Spotlight Background Fortune 100 Property & Casualty insurance carrier struggled with manual lead processing Faced issues with contact compliance and operational efficiency Needed a centralized, automated solution for lead…

Company Spotlight Background A leading U.S. financial institution catering to millions of customers nationwide underwent organizational restructuring across multiple business units Resources and teams were merged to support future initiatives …